Unlocking the Power of Smart Investment Choices

Understanding the Basics of Smart Investment

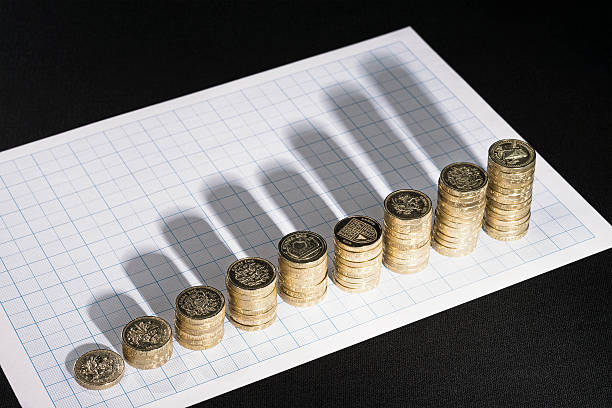

In the complex world of finance, making smart investment choices is crucial for securing your financial future and building wealth over time. Whether you’re a novice investor or have been in the game for years, understanding the fundamentals is essential. Smart investments are not just about choosing the right stocks or bonds; they involve a holistic view of your financial goals, risk tolerance, and time horizon. By aligning these elements, you create a strategy that maximizes returns while minimizing risks.

One of the keys to making informed investment decisions is staying well-informed about market trends and economic indicators. Nowadays, investors are also exploring alternative investments and considering opportunities beyond traditional markets. For example, some enthusiasts delve into sports betting as an unconventional investment strategy. If you’re interested in exploring such avenues, it might be helpful to read a comprehensive guide on the best football betting promo codes for Nigerian players. Websites like SurePredictz offer insights into optimizing your betting investments, emphasizing the importance of strategic decision-making even in non-traditional fields.

Exploring Diversification as a Strategy

Diversification is often lauded as one of the most effective strategies for reducing investment risk. By spreading investments across different asset classes, sectors, and geographical areas, you can mitigate the impact of adverse developments in any one particular area. It’s analogous to not putting all your eggs in one basket, ensuring that a downturn in one segment doesn’t result in a catastrophic loss.

A well-diversified portfolio can include stocks, bonds, real estate, and perhaps even alternative assets like commodities or cryptocurrencies. Each of these components reacts differently to economic changes, which helps stabilize returns. The effectiveness of diversification depends significantly on how these investments correlate with one another. Ideally, you want assets that do not move in tandem, so positive performance in one area can offset negative outcomes in another.

Leveraging Technology in Investment Decisions

In recent years, technology has revolutionized how we approach investments. Tools such as robo-advisors, mobile trading platforms, and artificial intelligence have made it easier for anyone, regardless of their financial expertise, to make informed investment choices. These technologies analyze vast amounts of data in real time, predicting trends, and offering personalized advice based on your financial goals and preferences.

Additionally, technology allows for more efficient portfolio management and a more comprehensive understanding of market dynamics. The accessibility of big data and predictive analytics means investors can identify opportunities and risks with unprecedented accuracy. As the investment landscape continues to evolve, embracing technology is no longer optional but a necessity for those looking to maintain a competitive edge.

SurePredictz: A Reliable Resource for Smart Sports Betting

If you are interested in exploring sports betting as part of your investment strategy, SurePredictz is a valuable resource. Specializing in football betting, they provide in-depth analyses and promotional codes specifically tailored for Nigerian players. Their expertise helps enthusiasts make informed bets, emphasizing the importance of strategy and research in achieving favorable outcomes.

By leveraging SurePredictz’s insights, bettors can gain a better understanding of odds, team dynamics, and competition contexts. This knowledge not only enhances the overall betting experience but also assists in making smarter, more strategic betting choices. For anyone considering the integration of sports betting into their investment portfolio, SurePredictz offers tools and knowledge essential for maximizing returns in this unconventional arena.